GET YOUR INSTANT PAN CARD THROUGH ADHAR

Instant PAN feature requirements

The following are the main requirements for getting instant PAN through Aadhaar-based e-KYC:

a The applicant must have a valid Aadhaar number which has never been linked to another PAN before.

b The base of the applicant should be linked to the registered mobile number.

c Support provides instant PAN paperless processing through the facility, so applicants do not need to submit or upload any KYC documents.

D. Applicant should not have more than one PAN. Applicants with more than one valid PAN will be penalized under the provisions of section 272B (1) of the Income-tax Act, 1961.

Finance Minister Nirmala Sitharaman introduced a new feature in Budget 2020 in which individuals can get Instant Permanent Account Number (PAN) through their Aadhaar without submitting a detailed application form. This facility was introduced to facilitate the PAN allocation process for individuals.

You can get instant e-PAN for free in just 10 minutes in soft copy format. If you doubt whether e-PAN will work for all purposes, here is the answer. Instant e-PAN is the equivalent of the PAN card you received after filling out the detailed application form.

PAN card is mandatory for many purposes like paying income tax, filing income tax return (ITR), opening a bank account or demat account, applying for debit or credit card etc. and you can use this e-PAN for all these purposes. The way you do with a traditional PAN card.

How to get instant PAN using this functionality?

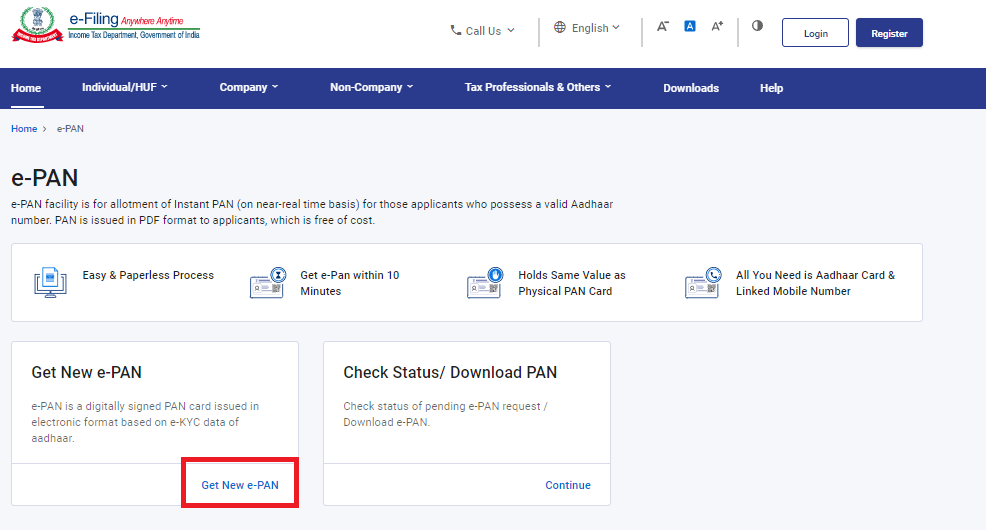

1. Go to https://www.incometax.gov.in/iec/foportal/ and click on the ‘Instant E-Pan’ option displayed on the home page.

2. Click on 'Get New e-PAN'.

3. Enter the base number.

4. Enter the OTP received on the mobile number linked to the Aadhaar number.

5. Validate the support details.

6. Validate the email id.

7. Download e-PAN.

You may know that e-PAN facility is for allotting instant PAN (based on near real time) to applicants who have valid Aadhaar number. Applicants are issued PAN in PDF format, which is free.

The Instant PAN feature can only be used by a person if the following conditions are met:

1. He / she has never been allotted PAN.

2. His / her mobile number is linked with his / her Aadhaar number.

3. His / her full date of birth is available on Aadhaar card.

4. He / she should not be a minor on the date of applying for PAN.

Immediate PAN allocation through Aadhaar

The new provision facilitates the issuance of instant PAN to individuals who already have a valid Aadhaar card. Applicants will not be required to submit a detailed application form like in normal cases. Instant PAN card will be issued in PDF format without any additional charge.

The PDF contains a QR code with demographic details, such as name, date of birth and photographs of the applicant. You can use the 15-digit acceptance number to download the e-page from the income tax e-filing portal. A soft copy of e-PAN will also be sent to your registered email address.

You can apply for e-PAN on NSDL and UTITSL website, but you may have to pay a fee for it. On the other hand, you can get a free e-page on the Income Tax e-filing portal.

Applying for PAN through this method will automatically link your support with PAN.

How to Apply for Instant PAN Card Through Aadhaar

Step 1: Visit the official e-filing home page of the IT department (www.incometax.gov.in).Step 2: Click on the ‘Instant E-PAN’ option under the ‘Quick Links’ section of the homepage to redirect you to the instant PAN allotment webpage.

Step 3: Click on the ‘Get New PAN’ button to redirect you to the instant PAN request webpage.

Step 4: Enter your Aadhar number for PAN allotment. Select ‘I confirm that’ check box to confirm the undertaking and click on the ‘continue’ button.

Step 5: Enter the Aadhaar OTP received on your registered mobile number and click on the ‘Validate Aadhaar OTP and Continue’ button once you have agreed to validate your Aadhaar details with UIDAI.

Step 6: You will be redirected to the OTP Validation page where you will be required tick the checkbox to accept the terms and conditions and click on the ‘Continue’ button.

Step 7: Enter OTP and click on the check box followed by the ‘Continue’ button.

Step 8: In the next step, if your email ID is not validated, click on ‘Validate email ID’. Select the check box and click on the ‘Continue’ button.

You will be given an acknowledgement number once you have submitted your Aadhar details for validation. You can view the PAN allotment status by entering your Aadhaar number.

How to Check Status/Download Instant PAN

Step 2: Click on the ‘Instant E-PAN’ option under the ‘Quick Links’ section on the homepage.

Step 3: Click on the ‘Check Status/Download PAN’ button.

Step 4: Enter your valid Aadhar number and captcha code. Click on the ‘Submit’ icon once you are done.

Step 5: Validate your request by entering the OTP received on your registered mobile number within the specified time limit. Select the check box and click on the ‘Continue’ button to proceed to the next page.

Step 6: You will be redirected to a new page where you can check the status of your PAN allotment request.

Step 7: In case the PAN allotment was successful, a PDF link will be generated within 10 minutes to download your PAN file.

Note: The PDF file containing your PAN is password protected. Use your date of birth in the format ‘DDMMYYYY’ as the password to open the PDF file. A sample PAN PDF file would look like this:

Frequently Asked QuestionsCan I apply for e-PAN through Aadhaar if I have lost the Aadhaar card?

No comments:

Post a Comment